Vertex Address Validation

Vertex is a leading provider of corporate tax software and services.

Where the Vertex Tax Provider integrates with Vertex to calculate sales tax for an order, the Vertex Address Validation provider is used to validate and normalize the address those calculations are based on, which ensures that taxes are calculated on the right grounds.

As such, this is for US domestic use only, and only in conjunction with the Vertex Tax Provider.

Register an account

If you’re using this, you already have a Vertex account from following the procedure described on the Vertex Tax Provider – and therefor a trusted id and a company code.

At the time of writing no further action was required to enable or add address validation to an account.

Provider configuration

To create and configure the provider:

- Go to Settings > Ecommerce > Orders > Address validation

- Click New in the toolbar to and cofigure the basic address validator settings (name, countries, exempt user groups)

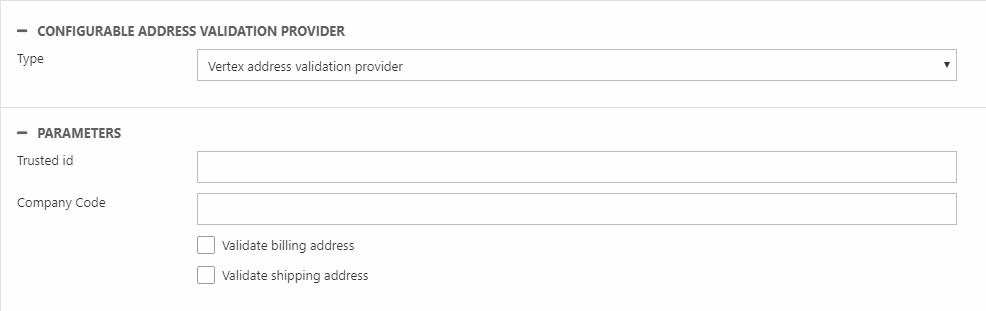

- Select the Vertex address validation provider (Figure 3.1)

- Enter your trusted id

- Enter your company code

- Select which addresses – billing and/or shipping – which should be validated

- Save

Using the validator

To the address validation service in your order flow, use the AddressValidators loop and its associated tags. Inside this loop, you have access to the Ecom:Order.AddressValidator.ErrorMessage loop, which renders address validation errors if the validation fails.

You can find an example of address validation in the default Shopping Cart template InformationAddressValidation.html template, which is located in Files/Templates/eCom7/CartV2/Step