Vertex Tax Provider

Vertex is a leading provider of corporate tax software and services.

The Vertex Tax Provider integrates with Vertex Cloud Indirect Tax which then calculates which taxes are owed to which authority for the American market – a complicated market where Value Added Tax (VAT) is not the preferred consumption tax.

The Vertex Tax Provider is therefore for US domestic use only.

Creating a test account

If you don’t have an active Vertex Cloud Indirect Tax account, please visit Vertex and sign up for one. You may have to contact Vertex to obtain test account credentials.

After your account is set up, you can login to the administration portal and retrieve the following information:

- Trusted ID (at the time of writing found in the Settings section)

- Company Code (at the time of writing found in the Configure section – you may have to create a Company first)

Provider configuration

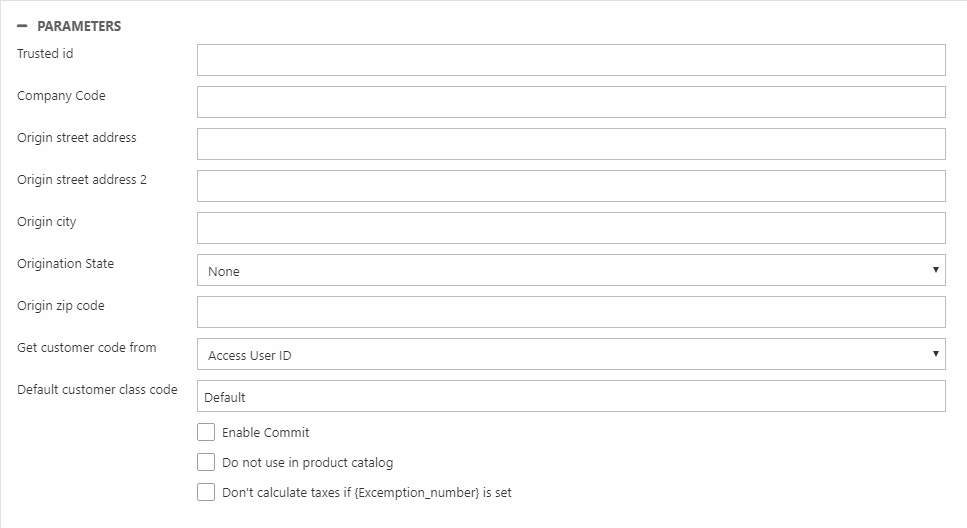

Create a new tax provider, select the Vertex Tax Provider add-in, and fill in the parameters (Figure 3.1).

You must:

- Enter the trusted ID from your Vertex administration portal

- Enter the company code from the Vertex administration portal

- Enter the address from which the goods are being shipped (this impacts some tax calculations)

- Specify from where want to retrieve the customer code sent to Vertex – AccessUserID, CustomerNumber, or the ExternalID field of the user identified by the AccessUserID. This gives you full flexibility as to decide where to store the customer number that is sent to Vertex.

- Specify a Default customer class code – this will be used if the “CustomerClassCode” user system field has not been filled in.

You can also check the following:

- Enable commit commits the transactions in AvaTax - if unchecked, the final commit call is not sent by Dynamicweb to Vertex, allowing shop administrators to have another system (e.g. an ERP) make the final tax commitment – until then, all transactions (sales, returns and invoices) are registered as uncommitted in Vertex.

- Do not use in product catalog disables rendering taxes from AvaTax in the product catalog. This will improve performance.

- Don't calculate taxes if (Exemption number) is set – this setting disables taxes for users with any value in the system field ExemptionNumber

When the provider is saved for the first time, three system fields for tax-related information are generated on each user:

- An ExemtionNumber field – used with either the Don't calculate taxes if (Exemption number) is set setting from above, or with a specific Vertex exemption code

- An ExemptionCertificate field – see Vertex Exemption Certificate Manager for details

- A CustomerClassCode field – see the Vertex documentation for details

Values entered in these fields will be used by Vertex to caculate taxes.