VAT

VAT – Value Added Tax – is a form of consumption tax popular in Europe, Japan, and many other countries. VAT taxes the difference between the seller-purchased price and the resale price, i.e. the value added.

Dynamicweb contains the the following features for handling different VAT scenarios:

- System VAT

- Country VAT

- VAT Groups

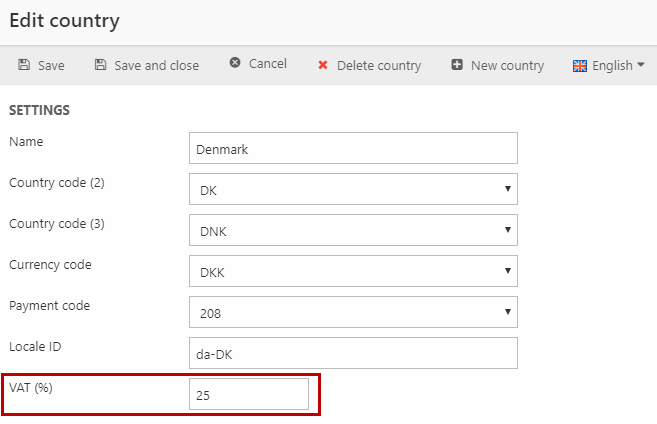

During checkout, VAT is calculated based on the billing country with the most specific VAT rate being used, i.e. VAT Groups > Country VAT > System VAT. In some cases it is desirable or required by law to calculate VAT based on the delivery country – you can enable this and other advanced settings under our advanced Prices settings.

In addition to the normal VAT hierarchy described above you can also set up Reverse charge for VAT, which

System VAT

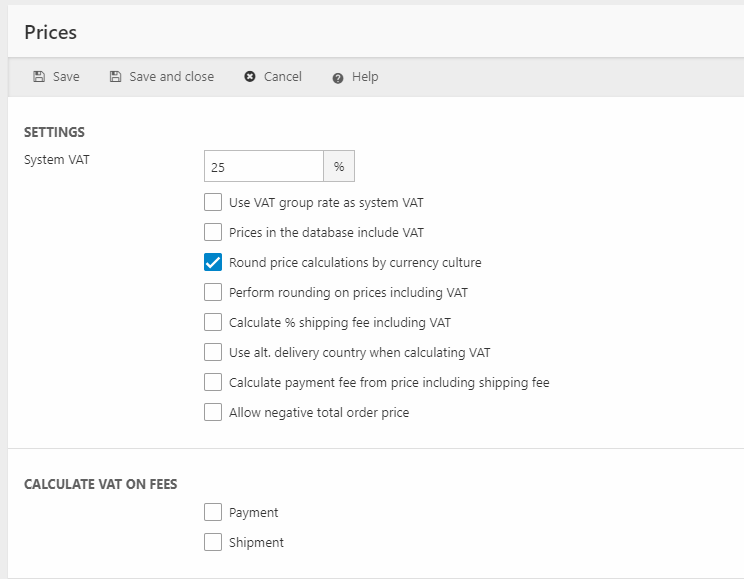

The System VAT rate is set under Settings > Ecommerce > Advanced configuration > Prices (Figure 2.1).

It is used for two things:

- As a fallback value – It is applied to all products unless a more specific VAT rate is defined, e.g. a Country VAT rate

- To recalculate VAT – If prices in the database include VAT, we use the system VAT rate to subtract VAT from products before recalculating VAT rates for other countries

To mark prices in the database as incl VAT, go to Settings > Ecommerce > Advanced configurations > Prices and check Prices in the database include VAT.

VAT Groups

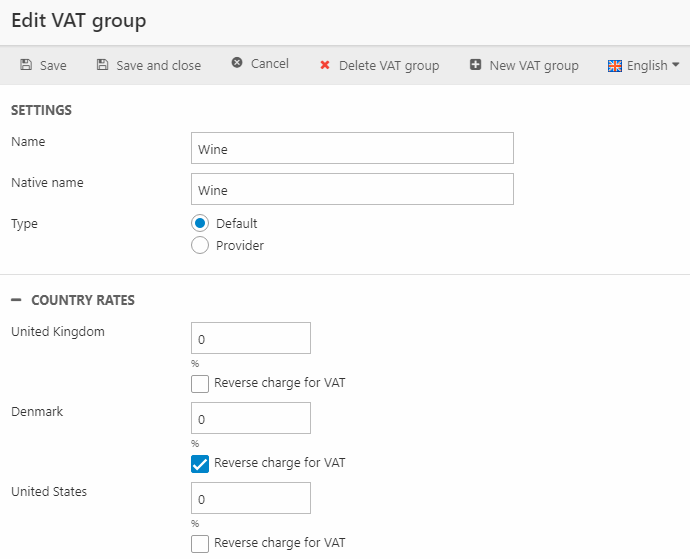

VAT Groups exist to handle differentiated VAT rates, for cases where some product and services are exempt from or have a reduced VAT rate.

To create a VAT Group:

- Go to Settings > Ecommerce > Internationalization > VAT Groups

- Click New in the toolbar to open the VAT Group window (Figure 4.1)

Configure the VAT Group:

- Add a name and a native name (system name)

- For each country set the country-specific VAT rate

- If applicable, check Reverse charge for VAT

Once created, a VAT group must be applied – this is done at the product group level. If a product belongs to different VAT groups in different countries, you can use the VAT Groups matrix to handle that.

EcomVatGroups

Contains vat group (VatGroupId) setup from Settings -> Ecommerce -> Internationalization -> Vat groups and translations of them (VatGroupLanguageId).

| Field name | Data type | Length | |

|---|---|---|---|

| VatGroupId | nvarchar | 50 | |

| VatGroupName | nvarchar | 255 | |

| VatGroupLanguageId | nvarchar | 50 | |

| VatGroupVatName | nvarchar | 255 | |

| VatGroupConfigurableVatProviderSettings | nvarchar | Max | |

| VatGroupAutoId | int | 4 |

EcomVatCountryRelation

Defines which vat group translations (VatCountryRelaGroupId, VatCountryRelLangId) are active for a country (VatCountryRelCountryId).

| Field name | Data type | Length | |

|---|---|---|---|

| VatCountryRelGroupId | nvarchar | 50 | |

| VatCountryRelCountryId | nvarchar | 3 | |

| VatCountryRelLangId | nvarchar | 50 | |

| VatCountryRelVat | float | 8 | |

| VatCountryRelAutoId | int | 4 | |

| VatCountryRelReverseChargeForVat | bit | 1 |